Paid Sick Leave Guidance You Can Use Right Now!

By Todd Masuda

The Families First Coronavirus Response Act (FFCRA) paid sick leave law took effect on April 1, 2020. On March 31, 2020 the IRS came out with guidance on the paid sick leave key questions we discussed on Monday, in a concise FAQ. The next day (the actual effective date) the DOL came out with a meaty 124 pages of interim regulations on the same topic (the final DOL rule is set to be published on April 6). Fortunately, the two documents provide sufficient guidance for employers to start administering FFCRA sick leave with confidence.

Rather than explicate the layers of detail set forth in the documents (which are substantial), I’d like to summarize and clarify the practical concerns I’m hearing from employers: how do employers require notice of leave; how must the employee document the need for leave; what documents does the employer have to provide for the tax credit application; and when can employers deny leave?

Employee Notice. Employers can require “reasonable notice” of leave, but notice requirements are employee-friendly. Employers may require notice as soon as practicable, but may not require notice in advance of leave. Notice of leave can be given verbally, and by someone else on behalf of the employee if the employee is unable to do so personally.

Employers can reasonably require the notice to have enough information to determine FFCRA leave, but the notice requirement may not include more information than described in the Documentation section below.

Note that the IRS FAQ allows the employer to require a written request, which is at odds with the DOL regs. The DOL says authority to issue the rules lies with the DOL, so, to the extent the IRS FAQ and the DOL regs differ, we recommend following the DOL guidance.

Employee Documentation

After the employee gives notice, the employee must still provide written documentation regarding FFCRA leave. This documentation provides the employer with the basis for administering leave and applying for the tax credit, and imposes stricter conditions on the employee. Here is the basic information employers can require in the FFCRA documentation:

- The employee’s name;

- The date or dates for which leave is requested;

- A statement of the COVID-19 related reason the employee is requesting leave and written support for such reason (see table below); and

- A statement that the employee is unable to work, including by means of telework, for such reason.

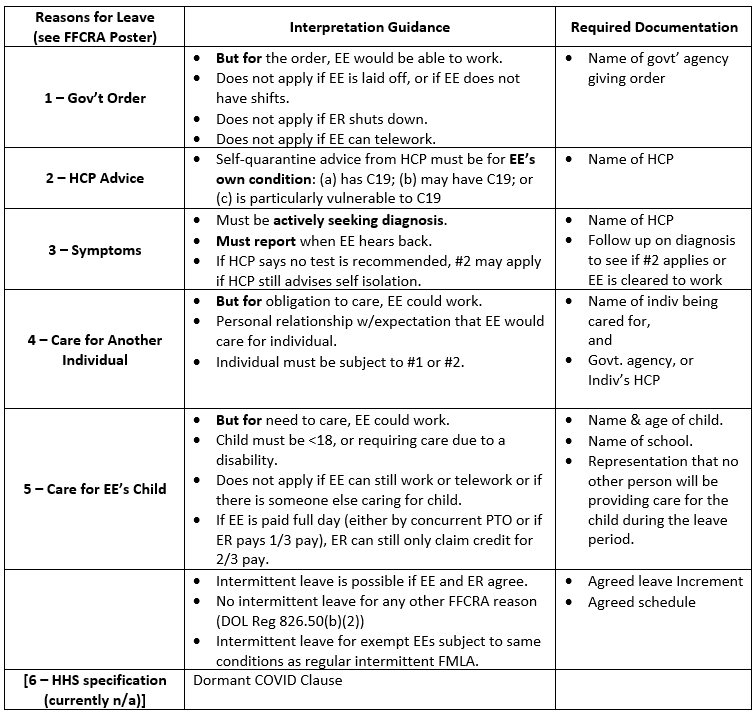

The regulations and IRS FAQ provide good guidance on interpreting the six reasons for leave, and describing the documentation sufficient to establish the need for leave. Here is a thumbnail summary of the guidance (n.b., the regs go into a level of specificity that this summary can’t cover, so please consult an attorney before finalizing any policies or documentation).

What are the employer’s recordkeeping requirements? (IRS FAQ #45 & 46)

Employers must maintain the following FFCRA records for four years:

- Documentation to show how the employer determined the amount of qualified sick and family leave wages paid to employees that are eligible for the credit, including records of work, telework and qualified sick leave and qualified family leave.

- Documentation to show how the employer determined the amount of qualified health plan expenses that the employer allocated to wages. See FAQ 31 (“Determining the Amount of Allocable Qualified Health Plan Expenses”) for methods to compute this allocation.

- Copies of any completed Forms 7200, Advance of Employer Credits Due To COVID-19, that the employer submitted to the IRS.

- Copies of the completed Forms 941, Employer’s Quarterly Federal Tax Return, that the employer submitted to the IRS (or, for employers that use third party payers to meet their employment tax obligations, records of information provided to the third party payer regarding the employer’s entitlement to the credit claimed on Form 941).

How should employers handle withholding and payroll? (IRS FAQ #58)

Employers will generally be able to handle payroll and withholding as usual, with the same deductions and withholding, as long as they maintain a clear record of amounts paid under the FFCRA. The employer reimbursement is handled through the quarterly tax credit (along with the advance credit application, if applicable).

When can the employer deny paid leave?

The written documentation supporting FFCRA leave is required. The employer can deny paid leave until the employee provides sufficient documentation. Employers are encouraged to give employees plenty of opportunity to provide documentation.

Paid leave is not available for employees who stay home without a qualifying reason. This includes employees who stay home without symptoms.

What about the <50 employee exemption?

The law allows employers with fewer than 50 employees to claim an exemption from the child care leave only. DOL Regs 826.40(b).

Claiming the exemption requires a determination by an “authorized officer” of the business that:

(i) The child care leave request “would result in the small business’s expenses and financial obligations exceeding available business revenues and cause the small business to cease operating at a minimal capacity”;

(ii) The absence of the employee or employees requesting child care leave “would entail a substantial risk to the financial health or operational capabilities of the business because of their specialized skills, knowledge of the business, or responsibilities”; or

(iii) There are not sufficient workers who are able, willing, and qualified, and who will be available at the time and place needed, to perform the labor or services provided by the employee or employees requesting child care leave, and these labor or services are needed for the small business to operate at a minimal capacity.

The officer’s determination is kept in the employer’s files, and is not submitted to the DOL at the time of determination.

But employers should reflect on the penalties for improperly creating an exemption under the PSLA, which is considered an FLSA violation entitling employees to unpaid amounts, 100% liquidated damages, plus attorney fees; along with potential personal liability for the “authorized official” who prepared the determination. Weighing the murkiness of the exemption language, the relatively small cost of providing paid leave, and the severe penalty for getting the exemption, the <50 employee exemption as a trap for most employers.

Other exemptions: employers of health care providers and first responders; postal workers; some federal employees.

What about self-employed people?

The paid sick leave credit also applies to the self-employed. Self-employed people will claim the credits on their 2020 Forms 1040, and will count against their SECA tax. The amount of the tax credit for self employed taxpayers is based on a daily wage calculated by taking the individual’s net earnings for the year, divided by 260.

**This information is offered for discussion, marketing and news purposes and is not intended to constitute legal advice.**